With the backdrop of higher interest rates, a number of e-commerce names across our European Internet coverage have shifted gears with an increased focus towards profitability, and are looking to monetise their data and digital inventory. Retail media is evidently a compelling proposition, implying margins between 70-90% for onsite and 20-40% for offsite. While many of the mature US players are already seeing a significant portion of their profit being driven by retail media, European Internet is arguably still at a relatively more nascent stage with lots more of the upside potential yet to come. We think that European Internet e-commerce platforms should generally be larger beneficiaries of the retail media opportunity than their brick-and-mortar counterparts given that ~100% of sales are via online channels (web/apps).

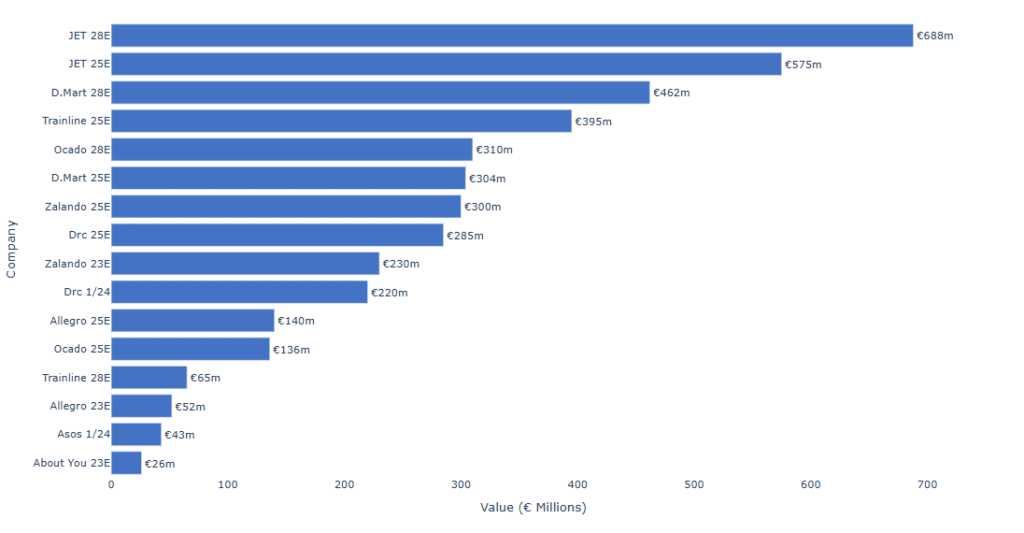

However, we acknowledge the challenges and opportunities faced by these players. To begin with, servicing a specific vertical (say food delivery or fashion) necessarily limits the pool of potentially interested advertisers compared to advertising on Amazon or Walmart. The European companies that we think have the most meaningful exposure to the retail media opportunity and therefore run financial scenario analysis for these companies: Deliveroo, Just Eat Takeaway, Delivery Hero, Allegro, Ocado, Zalando, About You, and Trainline. We compare and contrast their relative maturity and positioning in the market and run scenario analyses to estimate the potential margin upside. The names within our coverage that screen best are the following:

Allegro: Given Allegro’s relative under-indexing in ad revenue vs. other e-comm platforms, we see potential upside. In our view, Allegro is the ‘top of the funnel’ for a high proportion of retail searches in Poland. We think that 1) high market share in the region, 2) high third-party (3P) brand penetration, and 3) relatively mature retail media business in terms of tech capability mean it should be well positioned to benefit from growing ad revenues. Ad revenues stand at ~1.5% of GMV today, and we think that Allegro could achieve ad revenue as high as ~3-4% of GMV over the mid to long term, albeit there is no formal target.

Zalando: Retail media is a relatively more nascent proposition for online fashion versus food retail. However, Zalando has been an early adopter and has offered advertising/marketing services to partners as early as 2015. In our view, Zalando screens well due to its high market share of online fashion particularly in DACH, high 3P brand penetration (~95%) and relatively more mature retail media solutions. Ads are 1.3% GMV in ’23A; company targets 3-4% long term.

Food Delivery – Deliveroo, Delivery Hero, Just Eat Takeaway: We think online food delivery is a vertical that in theory should stand to benefit from retail media, particularly in grocery where CPG company engagement is high. It has relatively high user engagement and transaction frequency, and a relatively seamless integration of sponsored product listings into the user interface. We see an opportunity for all 3 players. Delivery Hero was perhaps an earlier adopter of retail media, and ad revenue is already at a run rate of ~2% of GMV. However, we think Deliveroo and Just Eat Takeaway are also well positioned to benefit from this growing market, although they have a slightly less mature retail media platform than Delivery Hero has currently. JET’s relative lack of scale in grocery, although this is being addressed, puts it perhaps slightly behind, in our view.

We screen our coverage against certain proxies for factors we think determine how well positioned companies are to capitalise on retail media growth: market share, online penetration, brand penetration, customer data and existing retail media business. Allegro screens best, in our view. This makes sense to us as they are best positioned to replicate Amazon’s success in Europe to become the ‘top of the funnel’ for a high proportion of retail searches in Poland. We think that 1) high market share in the region, 2) high 3P brand penetration, and 3) relatively mature retail media business mean it should be well positioned to benefit from growing ad revenues. Food delivery names screen equally well, with Delivery Hero leading the pack (size advantage, relatively advanced retail media offer with highest retail media share as a percentage of GMV). Boohoo screens at the bottom (no retail media business, mostly own-label with limited 3P exposure). Trainline screens equally poorly (less attractive end market exposure with arguably less relevant data points, in our view).

We see significant potential for margin accretion in our coverage. That said, we think this incremental revenue / EBITDA may potentially not drop through, but may instead be reinvested in the customer proposition or additional advertising to drive volumes, which makes sense, in our view. The actual contribution of retail media to total EBITDA may thus be lower. Either way, we view the strong growth in high-margin revenue as a very positive development for our companies, giving them more flexibility in the balance of managing margins and driving growth.