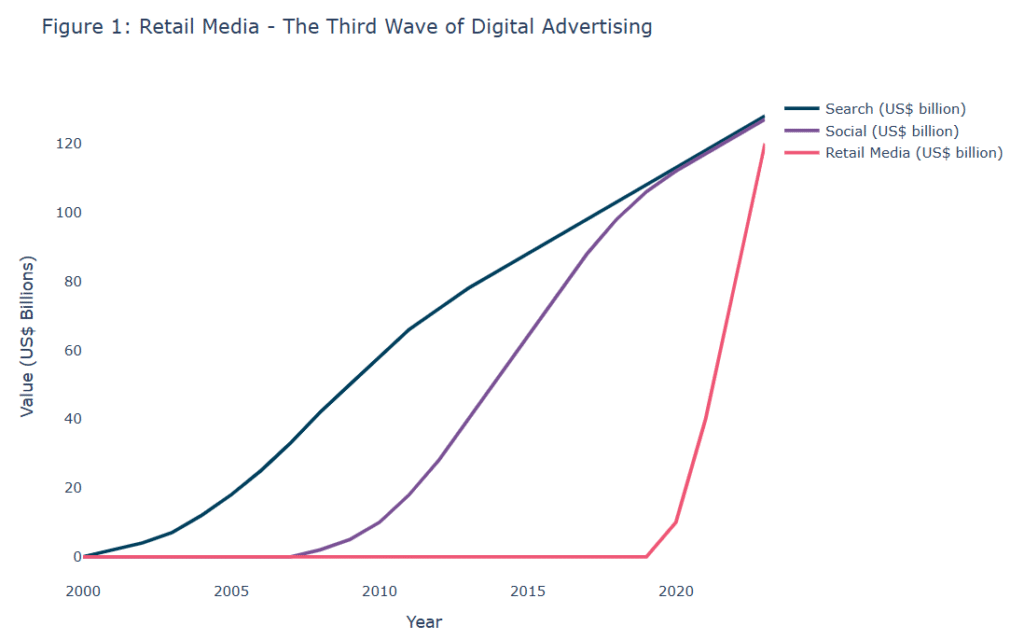

Retail media is considered the third wave of digital advertising after Search and Social. The market value went from US$10bn to more than US$100bn in just 6 years, something that took Search and Social 14 and 8 years, respectively, to achieve. The main driver behind that impressive growth has come from one player that has become a paradigm for how to profit from advertising: Amazon. However, the opportunity lies well beyond Amazon, with many retailers and e-commerce platforms having launched advertising businesses of their own.

Retail media is the solution to the identity problem

The rise of retail media has been nothing short of spectacular in the past five years. This trend should be sustained and even accelerated as it solves a lot of problems facing digital advertising in an era of heightened consumer privacy, making first-party shopping data more valuable. Retail media allows brands to promote their products and services on retailers or third-party websites, using retailers’ first-party data to target customers at critical points in their shopping journey. The appeal is reaching consumers at the right time in the right place with the right product.

First party is redefining retailers playbook on running custom experience including sponsored product ads.

Retail media defined

Retail media is a form of digital advertising that allows brands to promote their products and services on retailers’ websites (on-site) or on third-party websites (off-site), leveraging retailers’ first-party data to target customers at critical points in their shopping journey. There are three different types of retail media today: onsite, offsite and in-store. The vast majority (~90%) of retail media today is onsite: advertising on a retailer’s own inventory, including its websites and apps. The two most common ad formats here are sponsored products and display ads. Sponsored products appear organically as part of the search results while display ads promote a brand or a product through a static banner or video where shoppers can click through to get to sponsored brand pages. Offsite retail media refers to advertising using retailers’ data outside of their own inventory. Offsite is small today at ~10% of the mix but is set to grow in importance and reach ~30% within the next 2-3 years, partly fueled by signal loss in the open web from cookie deprecation (with Google now expected to stop Chrome from accepting cookies by early 2025). In-store is targeting shoppers with real-world, informed ads within the store, something which we expect to remain relatively small compared to the online potential of retail media.

Why retail media?

Advertising on a retailers’ website provides brands with a significant opportunity because they can reach consumers close to the point of purchase where conversion is higher and measurement or sales attribution is straightforward. Consumers are already in a shopping mindset and are thus much more likely to buy advertised products. Retailers have thereby found a way to monetise the first-party data from shoppers’ purchase histories. There is a received wisdom in adland: “Half the money I spend on advertising is wasted; the trouble is I don’t know which half.” This is less and less true with retail media. What’s in it for the retailers? In short, new revenue streams at very high margins. Retail media revenue is estimated to come with margins between 50-90%, which provides a compelling proposition for businesses with traditionally lower profit margins, in our view. Our analysis shows that retail media could add up to ~10-30% to our 2025E EBITDA forecasts for our European Internet names.