The beauty of retail media lies in it’s three different channels. These channels complement each other and their KPIs are also different. Each channel comes with its own advantages. In this explainer article, let’s look at these channels are how their market share and adoption.

Onsite

The vast majority (~90%) of retail media today is on-site: advertising on a retailer’s own inventory, including its websites and apps. The two most common ad formats, in that order, are sponsored products and display ads. Sponsored products appear organically as part of the search results and are often labelled “sponsored” or “promoted”. To benefit from this search, brands pay retailers for better visibility into search results. And typically, the higher up the product in search results, the more likely the purchase.

Criteo estimates that 90% of online purchases are those that appear on the first page. Amazon is particularly known for a high share of sponsored products of total search results. Display/ banner ads promote a brand or a product through a static banner or video where shoppers can click through to get to sponsored brand pages. We will dive deeper into the value chain of retail media here, but the basic idea is this: retailers’ onsite ad inventory is often aggregated by supply-side platforms (SSPs) and bought by brands or their agencies, either directly or through a demand-side platform (DSP).

Retailers then earn both through the brand’s advertising spend as well as from every click that generates a sale (CitrusAd estimates average conversion rates of 60%). The basic idea is reaching customers at the right time, in the right place with the right product. The ROAS here should thus be highest as customers are reached close to the point of purchase.

Platforms : Criteo, Citrus, Zitcha, Gowit, Pentaleap, Kevel

Off-site

Off-site retail media refers to advertising using retailers’ data outside of their own inventory. This can range from ads appearing on search engines triggered by keywords to display banner ads on third-party websites/ publishers, social media or connected TV. The vast majority of experts we spoke to include only those ads in off-site that redirect shoppers through a link to the retailer’s own website for purchase. A minority see off-site as any advertising that is activated using a retailer’s data, whether it links back to the retailer or not. We stick with the first definition, which appears to be the industry consensus.

These campaigns can be bought and delivered through the common channels (for instance, programmatically through a Demand Side Platform (DSP) and Supply Side Platform (SSP)), directly from the brand or through an agency. With the loss of third-party cookies, advertisers need to find an alternative to target consumers, and using retailers’ first-party data can be a very effective way to do so. Unsurprisingly, this comes at lower margins than the 70-90% range for on-site spend, going more parties are involved that take a slice of the cake (agencies, ad-tech platforms, publishers, etc.; ).

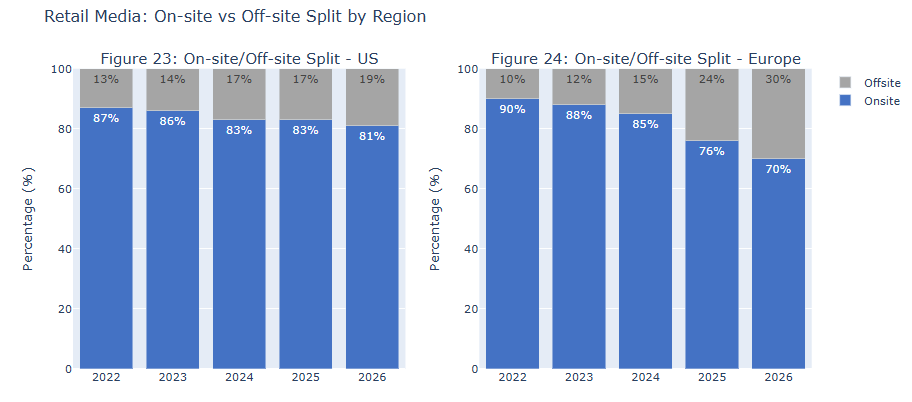

Onsite vs Offsite

According to estimates from IAB, BCG (ref) and E-marketer, the on-site/off-site split currently lies at 10%/90% but is set to shift to 30%/70% over the next four years, partly driven by the loss of digital identifiers, like third-party cookies, across the open web. There is only so much ad inventory that retailers can offer on their own websites, and off-site provides access to a much wider audience.

More importantly, signal leakage across the system post IDFA and post 3P cookie phase-out makes targeted advertising on the open web more challenging and in turn makes first-party shopper data more valuable. This signal loss on the open web should result in moving ad budgets away from impacted channels and towards retail media. Growth in off-site is likely the natural progression for retail media and should be one of the main drivers behind future growth.

Platforms : DV360, Adform. Stackadapt, Meta

In-store

The third, though much smaller and nascent, piece of the puzzle is in-store activation – i.e., targeting consumers while they are shopping in brick and mortar stores. Retailers’ shopper data is used to deliver targeted advertising on digital screens in the store or inform events like sampling. These digital displays (TVs, self-checkout screens, etc.) can, in theory, offer recommendations based on the customers’ purchase history. Amazon launched an in-store inventory opportunity in 2022, allowing brands to programmatically run ads on digital screens throughout Amazon Fresh stores in the US (Link, 26/10/23). Microsoft’s Promote IQ launched an In-Store proof-of-concept in January 2023, suggesting it would become available to advertisers within 12 months (Modern Retail, 10/01/23).

While there are numerous examples in the trade press that see an “enormous untapped opportunity” in in-store retail media, pointing to the fact that the vast majority of retail sales are still taking place in physical stores (85% in the US; Link), we remain somewhat sceptical. In-store retail media effectively is addressable digital out of home (DOOH). To date, campaigns are mostly tailored according to store location, time of the day and weather. There are private companies working on personalised targeted in-store advertising, including Cooler Screens and Advertima, which use proximity sensors and cameras to note when customers are approaching, measure their emotions, etc.

The technology has arguably been available for a number of years but we are yet to see widespread adoption, presumably a function of the perceived intrusiveness of the technology. Off-site will undoubtedly grow in size and importance. However, we do not currently see the upside from in-store activation as material enough to let it feed through to our numbers. The two names in our coverage with exposure to in-store are Ströer and JC Decaux which have both done a number of deals with retailers to drive targeted advertising.