An interesting case study regarding the power of retail data is the launch of Amazon’s Prime Video. Amazon introduced advertising within Prime Video in its main markets between January and April this year. The launch of ad tiers by Netflix and Disney+ has not yet reached initial expectations for many reasons (high prices, lack of measurement, lack of targeting data among others), but we believe that Amazon will be different for three reasons:

Reach: Unlike Netflix and Disney+, Prime Video subscribers will have to actively leave their current tier to avoid ads and various surveys put the percentage of Prime Video users willing to do that at 15-20%. In other words, Prime Video will launch with 160-170m monthly ad viewers globally on Day 1 while Netflix and Disney launched with 0 ad viewers globally on Day 1. Penetration of Amazon Prime is also above the main SVOD platforms in most countries (SVOD penetration might be above Prime penetration, but then you have to take market share into account, SVOD being a competitive space).

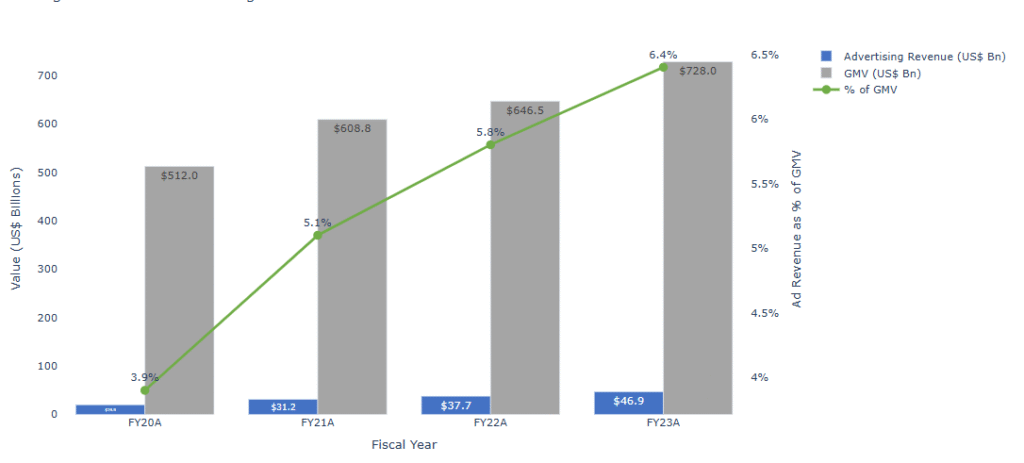

Data: Amazon knows where you live. And what you buy. And many other things. Therefore they should have unparalleled targeting data and a very clear return on investment story, which advertisers should love and pay for. This is the main reason why Retail Media has proven so popular.

Lessons learned: By launching after others, Amazon should be able to learn from their mistakes (prices, measurement, tech not TV personnel etc).

We assess what could be the negative impact of Prime Video advertising on broadcasters and model Prime Video potential revenues in France, Germany, Italy, Spain, the UK and the US. By and large, we estimate a 4-6% impact in 2028E, i.e., a 1pp growth headwind every year from Prime Video ads. This is on top of previous headwinds for broadcasters. Retailers are the winners from retail media and agencies should benefit as well, in our view, while we believe the main losers are traditional media owners like broadcasters.