In our view, the primary beneficiaries of retail media are retailers and e-commerce platforms: they should be able to achieve significant incremental revenue at very high margins. However, advertising agencies should benefit too.

Firstly, retail media opens up new high-growth, higher margin verticals, such as servicing retailers with tech & data.

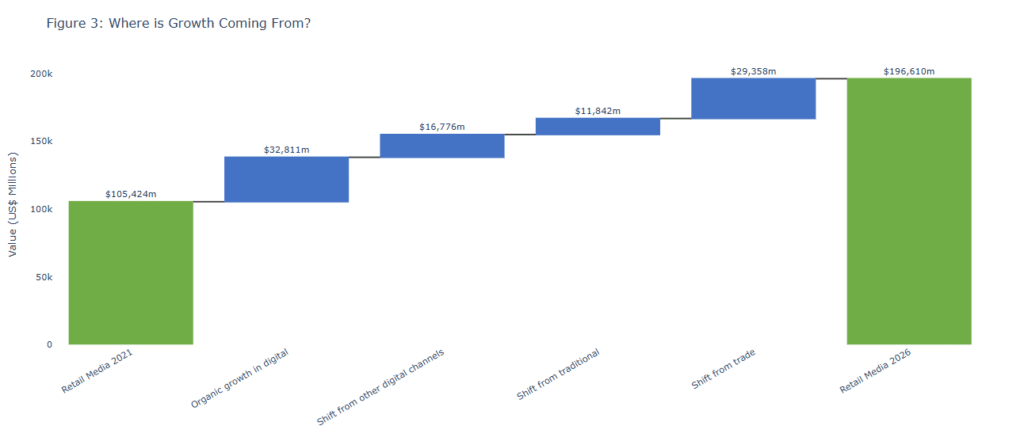

Secondly, it can grow the overall advertising pie by shifting trade dollars to brand budgets. Retail media’s complexity gives us confidence that there is less risk for agencies to be disintermediated than in other verticals. What’s more, retail data improves targeting, measurement and thus the return on adspend. Finally, we think the role for agencies is arguably even more important in offsite as it more closely resembles programmatic ad buying across a wide range of inventory. We thus see offsite taking share as directionally positive for the agencies.

We find less risk for in-housing in retail media than in other parts of the business. Our scenario analysis suggests that retail media can add 1.5pp to agencies average Media growth and take average agencies’ group organic to 3.9% from 3.5% in 2025E and to 3.4% from 3.0% in 2026E. In our blue sky scenario (accelerating growth, no in-housing, no cannibalisation), we could see retail media adding 4pp to Media growth and lift group organic growth to 4.8% from 3.5% in FY25E and to 4.3% from 3.0% in FY26E.

The agencies have slightly different exposure to retail media. Publicis services both brands and retailers and runs their own retail media Network with Carrefour. Omnicom has a higher exposure to buying on marketplaces and e-commerce consulting through the acquisition of Flywheel. Whether or not one or the other is better positioned for retail media buying and planning will largely depend on the data asset.

We see both Publicis and Omnicom ahead of WPP and IPG in retail media because they both go beyond simple media buying and planning. Publicis has been the most vocal about the growth opportunity with early strategic acquisitions with CitrusAd in 2021 and Profitero in 2022 on top of their earlier acquisition of data asset Epsilon. They have also launched Unlimitail, a retail media network with Carrefour that stands to benefit from fragmentation in the European retailer market. Omnicom has boosted their ambitions in retail and commerce with the purchase of Flywheel which positions them well to service both the retailer/ e-commerce as well as the brand side of retail media.